How Does Royal Q Stay Ahead of the Market Trends and Volatility

This article provides a detailed overview of how does Royal Q stay ahead of the market trends and volatility

How Does Royal Q Stay Ahead of the Market Trends and Volatility? Everything You Need to Know

As a crypto trader, your success in the quick-paced world of finance depends on being aware of market trends and volatility. This is particularly true for algorithmic or AI trading, where quick decisions have the power to create or shatter fortunes. Amidst all this, Royal has earned a massive reputation for being a reliable platform to automate crypto trading. Royal Q has kept ahead of market trends and volatility while constantly outperforming the competition thanks to its creative techniques and flexible algorithms. In this article, we will discuss how does Royal Q stay ahead of the market trends and volatility.

How Royal Q Works?

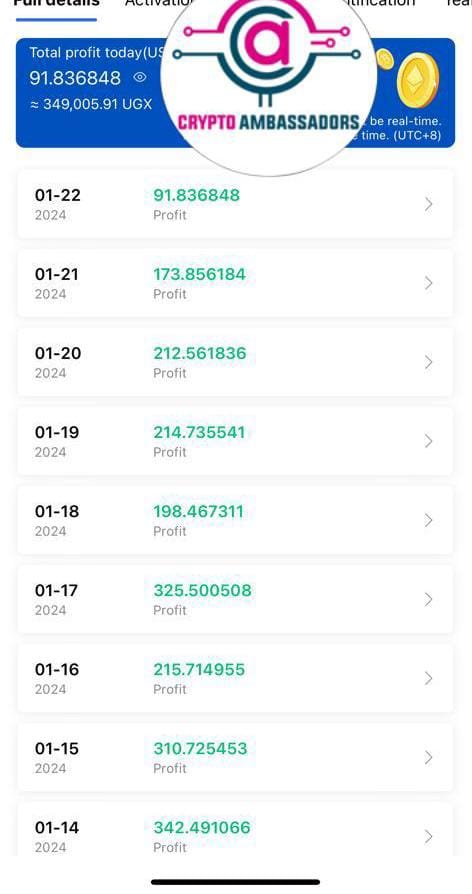

Royal Q bots automate the process of analyzing and interpreting cryptocurrency market data. The AI-powered trading Royal Q Bot employs advanced algorithms to assess market trends and make trades automatically. Its purpose is to give users an effective and easy way to trade in the financial markets. When compared to hiring human professionals, users can save time and effort by using Royal Q Bot to benefit from the bot’s capacity to make fast and precise trading decisions.

The bot has several features, including risk management tools, current market analysis, and trading methods, which can be customized to improve functionality. Royal Q Bot promises to optimize profits for its consumers by using AI. You will need to bind the app with a third-party trading platform to use the Royal Q trading bot. Currently, Royal Q only works with exchange networks such as, Houbi, Kraken, Bybit, Okx, Kucoin, Indodax, and Binance. You can bind your Royal Q account to any of these platforms.

Understanding Volatility and Market Trends

It is essential to fully understand market trends and volatility before learning Royal Q’s strategy. Market trends refer to the overall trajectory of the market’s progress over a given duration. The overall trend may be horizontal (neutral), upward (bullish), or downward (bearish). On the other hand, volatility describes how much a financial instrument’s price fluctuates over time. Significant price swings are indicated by high volatility, while low volatility means price stability.

How Royal Q Stays Ahead of Market Trends and Volatility

It can be hard for traders and investors to remain ahead of market trends and volatility. Accurately predicting market movements is known to be extremely challenging since it requires examining a wide range of parameters, such as investor sentiment, geopolitical events, and economic indicators. Additionally, market patterns and volatility are subject to sudden changes, so traders must be able to adjust to changing circumstances quickly.

Here is how Royal Q stays ahead of market trends and volatility:

Adaptive Strategy

Royal Q’s flexible strategy is the key to its success. Royal Q’s algorithms, in contrast to conventional trading algorithms, are made to constantly adjust to shifting market conditions based on predetermined rules and parameters. Combining machine learning methods, statistical analysis, and real-time data processing allows this adaptability.

Machine Learning

Machine learning is a fundamental element of Royal Q’s adaptive strategy. Using advanced machine learning algorithms, Royal Q can analyze vast volumes of past data and discover trends that could suggest upcoming market shifts. Such trends can represent anomalies that point to potential future price shifts, repeating market cycles, and relationships between various assets.

Statistical Analysis

In addition to machine learning, Royal Q uses extensive statistical research to detect volatility and market movements. Royal Q can use statistical models and procedures to assess the probability of different market outcomes and modify its trading tactics. Thanks to this data-driven strategy, Royal Q can make accurate decisions even in uncertain situations.

Real-Time Data Processing

Royal Q’s adaptive strategy also heavily relies on its ability to handle real-time market data. Royal Q can quickly adapt to shifting situations and grab new chances by keeping a close eye on news events and market conditions. Royal Q has a competitive advantage in quick-shifting markets where speed is crucial thanks to its real-time data processing capability.

Risk Management

Risk management is a top priority for Royal Q, even though its adaptable strategy allows it to take advantage of market shifts and volatility. Since the financial markets are naturally volatile, Royal Q uses strong risk controls to reduce any losses. Among these controls are portfolio diversification, stop-loss orders, and position sizing. Royal Q can protect against unfavorable market fluctuations and preserve capital by practicing good risk management.

Benefits of Trading with Royal Q

⦁ Your money is not being given to anyone. Royal Q may purchase and sell on your behalf multiple times as long as your capital and profit remain in your Binance, but you maintain complete control over the money because it stays in your Binance.

⦁ Whether you are sleeping or preoccupied with the day’s tasks, the “Dollar Cost Averaging Strategy” lowers the entry price of your trades when it runs automatically, reducing your floating losses in the case of a market downturn.

⦁ You do not have to monitor the market constantly on your phone or laptop. The bot continuously purchases, sells, and books profits on your behalf using your chosen set targets 24 hours a day, seven days a week.

⦁ Risk management is excellent when you use the “Margin Call Drop” tool to enter the market progressively rather than all at once.

⦁ Much like the Binance Exchange referral program, which pays referrers commissions from their referrals’ trades, you receive a small commission from your referrals.

Conclusion

Royal Q uses an adaptable strategy that blends machine learning, statistical analysis, and real-time data processing to keep ahead of market trends and volatility. Royal Q can recognize opportunities and reduce risks by consistently responding to changing market conditions. Furthermore, Royal Q guarantees long-term trading success by setting a high priority on risk control. I hope this article answers all your questions regarding how does Royal Q stay ahead of the market trends and volatility.